Algorithms are known as one of the best known processes to count the credit scores, and different well-known top-ranking credit scores companies use different methods to have their credit scores done, FICO is the best well known scoring method.

— BEACON score is being used by Equifax,and the Experian has the Experian/Fair Isaac Risk Model and Trans Union mostly use EMPIRICA score, it is also in different algorithm form.

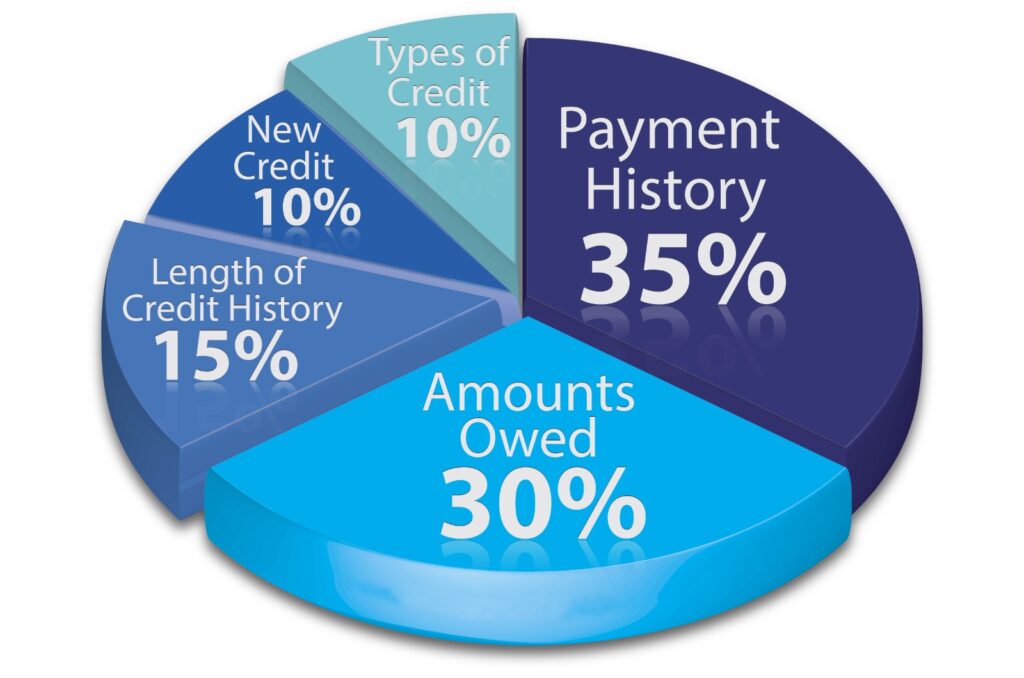

More or less it work like a school progress report chart where different percentages are given for fixed category of work you have done, your score will count your standard finally with the total percentages you received.

Approximately 35% is counted according to the payment procedure you have paid back to the bankers, they would see the time, date means how many was left out of collections and how many late payments were done.

Next 30% goes for the debt, that is how much you owe to them, that it how much debt you have for car and home, your score will be less if you have more card.

Everything is good at a long-term perspective and it will help you to get a long term benefit and time will give other necessary approximations about your payment.

This time factor deals with only 15%, another 10% deals with your applications and information about your other credit cards, why you have applied, and how many credit cards you have now. That means you need a loan at any cost so it can hamper your credit evaluation. Last but not the least percentage deals with all the recent credits you are dealing with.