Business Credit

Most small business owners start their business by using their personal credit and resources to start their business. Using your personal credit as a guarantee to pay for goods and services is a result of never realize that it is possible to obtain considerate credit for their business with no personal guarantee or personal credit inquiry hence, with no personal risk.

We will teach you that Business credit bases approvals on the credit profile and score of the business, not its owner. The business owner’s personal credit profile is not reviewed because it’s their business profile used to determine approval. The business is approved for credit, not the owner, meaning that there is no personal guarantee required in many cases.

This mini course will teach you the following strategies:

1. How to set up your business legal structure and entity:

LLC, Sole Proprietorship, LLP, Incorporated, and other legal structure. Most business owners don’t structure their businesses to have a legal buffer from their personal assets from liabilities.

2. Avoid adverse effects of a business owner using their personal credit for business debts.

Your personal credit should be separated from operating a successful business. Therefore, it is critical that you establish business credit. You will learn the strategies of increasing your business credit and manage the credit to get approved for more lines of credit. This is all done by your business credit report, merchant relationships, and timely reporting of your business credit.

3. How to set up your business to obtain business credit.

Understand the business credit bureaus and what data they use to compile to generate a report about the company’s business credit transitions. When you understand how your business credit history is captured, you will learn how to get more business credit.

4. How to increase your business credit to get no personal credit check or guarantee from companies like:

Lowes, Home Depot, Office Max, Staples, BP, Shell, Wal-Mart, Sam’s Club, and thousands of merchants. Additionally, we will show you have to make money using these same companies by joining a FREE refer program. Equally, you can start a parallel business, Market America UnFranchise Business, and make commissions or cashback. If starting another business is not your desire, you can still take advantage of purchasing what you need via a FREE account on www.Shop.com/deonhuff. And, last but not least, business owners secure credit cards.

5. Learn how to get business secure and unsecured credit cards.

Business credit cards are for companies and small businesses that want a separate account for their business spending. Business owners can easily track expenses, manage employee purchases, and earn rewards on business purchases.

6. The most important strategy is learning how your business credit is reported by several of the largest business credit reporting agency.

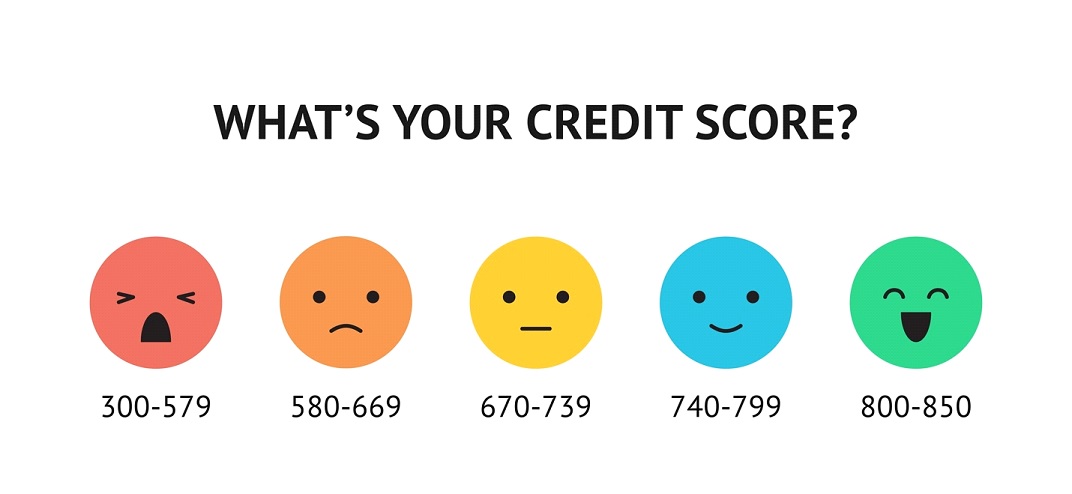

You already know how personal credit is reported to the 3 Credit Bureaus: Equifax, Experian, and Transunion. It is not a secret, but we will outline these agencies within this course. We can’t give you the store with all the secrets without attending the course. SMILE!

7. You will learn how to BUILD a strong business foundation.

The perception lenders, vendors, and creditors have of a business are critical to the business’s ability to build strong business credit. Before applying for business credit, a business must ensure it meets or exceeds all lender credibility standards. In total, there are over 20 credibility standards that are necessary for a business to have a strong, credible foundation. You will learn how to apply, build, and increase your business credit score to ensure you obtain new credit.

Learn how to Get Business Credit to Grow Your Business. You DON’T have to use your personal credit to build business credit! We will teach you how to build using strategic means.

Business Credit Building Course

$199

- How to start a Business Credit Profile & Score so you can look more CREDIBLE to Lenders & Credit Issuers

- How to get Vendor, Store & Cash Credit for your business with NO Personal Guarantee or Credit Check

- How to obtain Business Credit in as little as 3 months... Hint: it's about knowing what to do in the right order

- How to make money at the same time buying productions or services needed in your business

- Learn to build business credit without requiring no personal credit check, collateral or cash flow.